It’s a similar story in betting….

While risky bets aren’t harmful physically, they can certainly take a hefty toll on your wallet. The problem is, the relationship between risk and reward is usually linear, so if you want bigger rewards, you’re going to have to put your money at considerable risk.

The red arrow below shows the typical relationship between risk and reward:[/text_block]

There are several approaches that come to mind, including low-risk strategies like trading, matched betting, or even building a betting portfolio to spread your risk. However, these tactics can be very time consuming so we’re not going to focus on them in this article.

To keep things simple, let’s assume you’re looking for a single betting strategy, where you receive selections, bet them, and turn a profit…

In horse racing (and several other sports), the majority of the value is usually available at the lower end of the betting market i.e. where the odds are higher. In theory, this means that strategies providing higher priced selections will give you a higher return on your investment.

However, it would also mean putting up with longer runs of losers, and for many punters this is a deal-breaker.

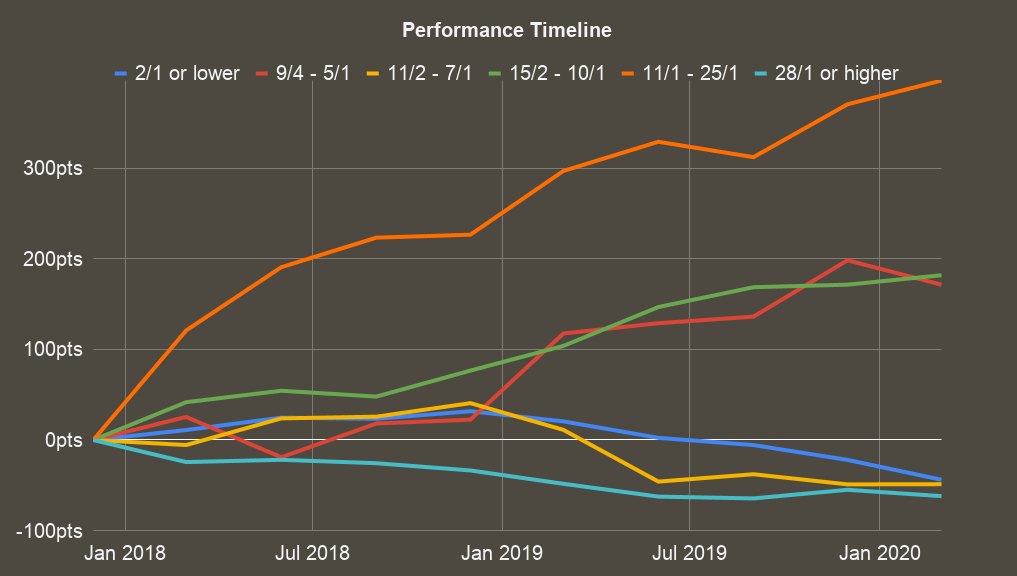

Let take a quick example from our Shortlist, to see how this looks in practise:[/text_block]

9/4 – 5/1

Number of qualifiers: 2946

Profitable bets: 1120

Strike rate: 38.02%

Points profit/loss: 171.45

Return on total staked: 5.82%

Annual ROI: 76%

[/text_block]

11/1 – 25/1

Number of qualifiers: 1515

Profitable bets: 423

Strike rate: 27.92%

Points profit/loss: 396.89

Return on total staked: 26.2%

Annual ROI: 176%

[/text_block]

Based on this example and what we know about value, it would seem a no-brainer to focus on strategies that provide higher priced selections…but is it?

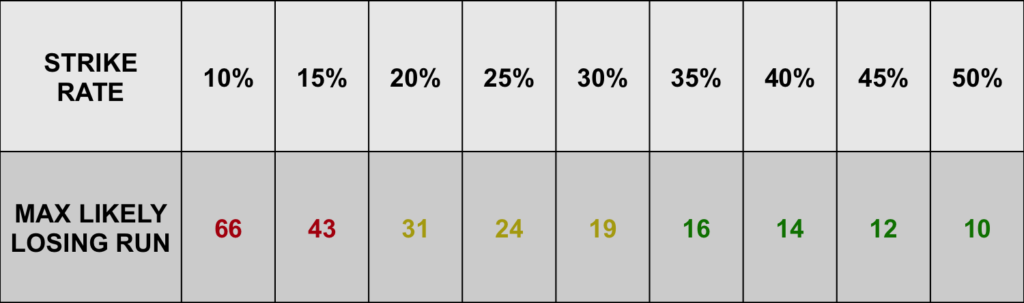

Before deciding, let’s take a closer look at the strike rate, and likely length of losing runs for each range. We can use the following table to help us:[/text_block]

For the high odds-range, it’s worth noting that we bet each way, and the strike rate of 27.92% includes all profitable bets (whether they win or place). The strike rate for winners only is quite a bit lower, at 15%…

This means the maximum likely run without hitting the frame is approx. 21 bets, and without hitting a winner is approx. 43 bets. The question is, could you continue to follow a strategy that occasionally gives you 43 losers in a row?[/text_block]

This might mean settling for a strategy with a lower return on investment, but higher strike rate. If it helps you to avoid quitting or chasing losses, and gets your into profit, it’s a worthwhile compromise.

With practise, you may also be able to improve your ability to handle losing runs…

You could try paper trading a low strike-rate, high odds strategy for a few months, and pay attention to the losing runs. If you think you can handle them, move onto small stakes and gradually increase them over time.

Emotional detachment from short term losses comes naturally to some, but not to others. As someone in the latter camp, I have definitely went beyond my limits, lost my grip and fell quite a number of times in the past. But once I’d come to terms with those limits, I was able to start profiting, and eventually even learned to handle the longer losing runs too.

This is what betting investment is all about; forging an iron-will, and using it to remain calm during times of adversity.

Developing an “investors mindset” can help you to maximise your rewards, while protecting yourself from unnecessary risk.[/text_block]