RISK AND REWARD

As an avid rock climber, I've been been forced to learn how to find balance between the risk I put myself in, and the reward I receive from a challenging climb. I say forced, because both the rock-face and gravity are ruthless teachers, and taking unnecessary risks in this sport can lead to serious injury, or worse.

It's a similar story in betting....

While risky bets aren't harmful physically, they can certainly take a hefty toll on your wallet. The problem is, the relationship between risk and reward is usually linear, so if you want bigger rewards, you're going to have to put your money at considerable risk.

The red arrow below shows the typical relationship between risk and reward:

The target represents one of the main aims of any horse racing investor; how can you maximise the reward, while minimising the risk?

There are several approaches that come to mind, including low-risk strategies like trading, matched betting, or even building a betting portfolio to spread your risk. However, these tactics can be very time consuming so we're not going to focus on them in this article.

To keep things simple, let's assume you're looking for a single betting strategy, where you receive selections, bet them, and turn a profit...

In horse racing (and several other sports), the majority of the value is usually available at the lower end of the betting market i.e. where the odds are higher. In theory, this means that strategies providing higher priced selections will give you a higher return on your investment.

However, it would also mean putting up with longer runs of losers, and for many punters this is a deal-breaker.

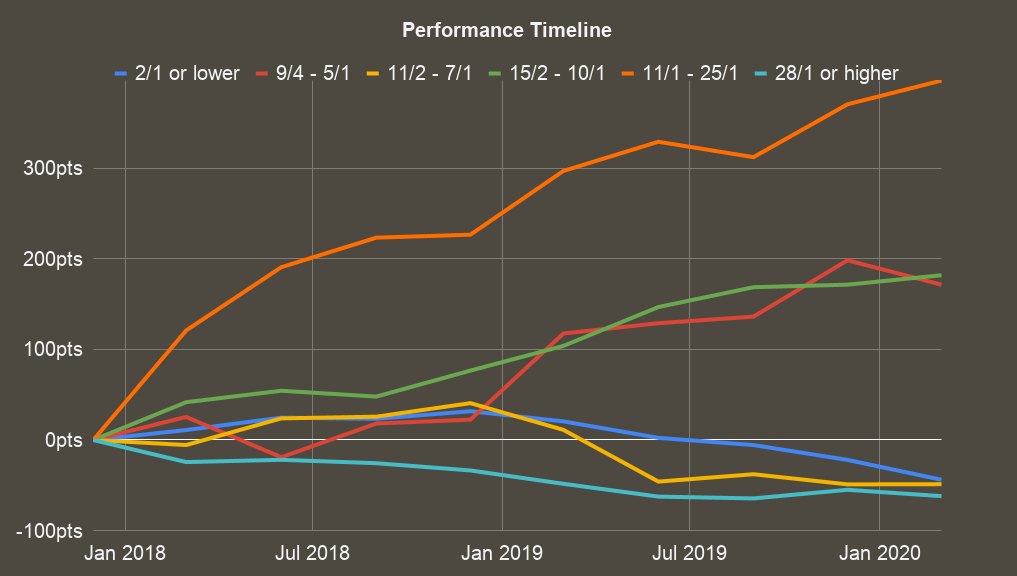

Let take a quick example from our Shortlist, to see how this looks in practise:

The above graph shows our Shortlist performance over the past couple of years, at various odds-ranges. For todays purposes, I'd like to concentrate on two of these; the most profitable odds-range from the lower end, which is 9/4 - 5/1 and shown in red, and the most profitable range from the higher end, 11/1 - 25/1 as shown in orange:

9/4 - 5/1

Number of qualifiers: 2946

Profitable bets: 1120

Strike rate: 38.02%

Points profit/loss: 171.45

Return on total staked: 5.82%

Annual ROI: 76%

11/1 - 25/1

Number of qualifiers: 1515

Profitable bets: 423

Strike rate: 27.92%

Points profit/loss: 396.89

Return on total staked: 26.2%

Annual ROI: 176%

The key figures to note include the "return on total staked", a respectable 5.82% for the lower odds range, but a much more impressive 26.2% for the higher odds range. Despite selecting a much lower number of bets, on a typical year the higher odds range would return you 176% on your investment, whereas the lower odds range would return you just 76%.

Based on this example and what we know about value, it would seem a no-brainer to focus on strategies that provide higher priced selections...but is it?

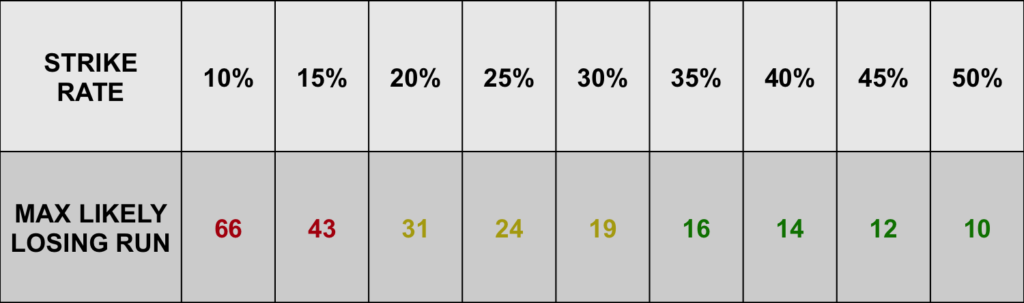

Before deciding, let's take a closer look at the strike rate, and likely length of losing runs for each range. We can use the following table to help us:

So, using the table we can see that the lower odds-range, with a strike rate of 38.02%, has a maximum likely losing run of approx. 15 bets.

For the high odds-range, it's worth noting that we bet each way, and the strike rate of 27.92% includes all profitable bets (whether they win or place). The strike rate for winners only is quite a bit lower, at 15%...

This means the maximum likely run without hitting the frame is approx. 21 bets, and without hitting a winner is approx. 43 bets. The question is, could you continue to follow a strategy that occasionally gives you 43 losers in a row?

Sometimes, being a profitable punter means knowing your limits, and choosing a strategy that works within those limits.

This might mean settling for a strategy with a lower return on investment, but higher strike rate. If it helps you to avoid quitting or chasing losses, and gets your into profit, it's a worthwhile compromise.

With practise, you may also be able to improve your ability to handle losing runs...

You could try paper trading a low strike-rate, high odds strategy for a few months, and pay attention to the losing runs. If you think you can handle them, move onto small stakes and gradually increase them over time.

Emotional detachment from short term losses comes naturally to some, but not to others. As someone in the latter camp, I have definitely went beyond my limits, lost my grip and fell quite a number of times in the past. But once I'd come to terms with those limits, I was able to start profiting, and eventually even learned to handle the longer losing runs too.

This is what betting investment is all about; forging an iron-will, and using it to remain calm during times of adversity.

Developing an "investors mindset" can help you to maximise your rewards, while protecting yourself from unnecessary risk.