SMALL BANKROLL, LARGE PROFIT?

Today I'd like to explore a commonly-asked question...

How can you produce a large profit from a small bankroll?

Well, as any semi-serious punter knows, the standard way to bankroll your betting is to invest a fixed amount of money (that, all importantly, you don't need for anything else), then stake an amount that will produce decent profit without unwarranted risk.

Of course, this depends on the strike rate of the betting strategy you're using, and your personal approach to risk.

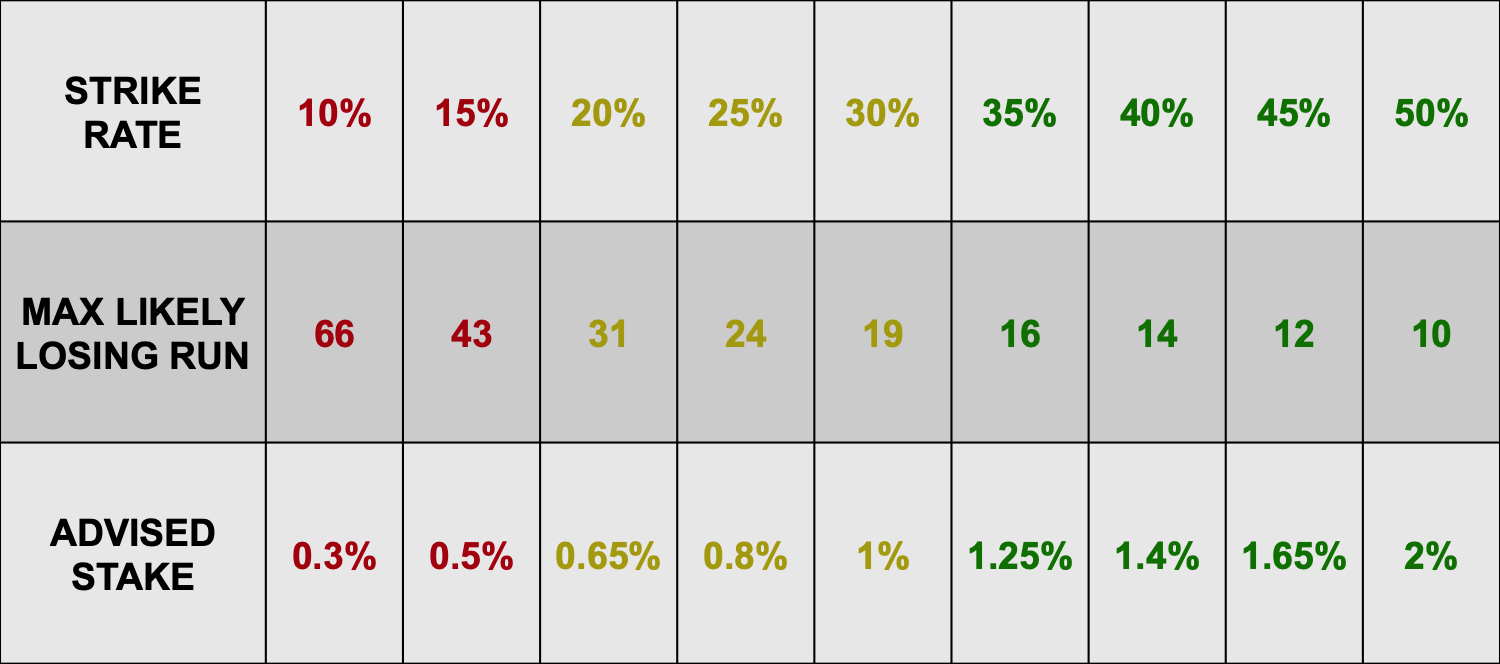

Here at Lucrative, we like to take the "protection first, profit second" approach so generally advise staking in a way that allows your bankroll to survive roughly 5 maximum losing runs, as laid out in the table below:

If we concentrate on the "advised stake" row, we can see that with this low-risk approach, a 50% strike rate merits staking 2% of your bankroll per bet, a 30% strike merits staking 1%, and so on.

Unless your laying or betting odds-on, you're very unlikely to achieve a strike rate of 50% or greater. And for most punters, a strike rate somewhere around the 30% mark is much more realistic.

However, this presents a problem...

If the idea of investing a lump four-figure sum doesn't appeal to you (and you'll be in the majority), you're advised starting stakes will look something along the lines of:

£100 bankroll: £1 stakes

£200 bankroll: £2 stakes

£500 bankroll £5 stakes

Nothing wrong with the above, of course, apart from the undeniable reality that smaller stakes mean smaller profits.

So...what, if anything, can we do to improve this dilemma?

One option would be the throw caution to the wind and up your stakes to 2% - 5%. Based on some of the research surveys I've carried out in recent years, this is exactly what a lot of punters do. If this tactic sounds familiar to you, you're definately not alone.

Unfortunately, it's a risky business and at 5% stakes, the chances that you'll go bust somewhere down the line is higher than you'd care to know. In short, I don't recommend it.

The other option is to use a Rolling Bankroll.

The idea behind a rolling bankroll is to start with a smaller investment, and set your stake so that it will cover your bets for the week (or month) ahead.

If you're in profit at the end of the week, great! You can either withdraw your profit, or add it to your bankroll and start the following week with a larger pot. If a loss is made during the week, a contingency plan kicks in where you top your bankroll back up to the original balance.

Let's use our BackLucrative Value tipping strategy as an example, to demonstrate how this works:

Strike Rate: 28.81%

Average bets per week: 20

To stake £10 per bet, you would require an approx. £1,000 fixed bankroll.

However, to stake £10 per bet with a rolling bankroll, you only require enough to cover a weeks worth of bets. Based on the average number of bets per week, this would be £200; lets up that slightly to £250, as there will be some weeks with more bets than the average.

With a £250 rolling bankroll, and £10 stakes, this is what the first four weeks of 2020 looks like following BackLucrative Value:

Week 1

Starting bankroll: £250

Bets: 19

P/L: +5.25 points

Bankroll after week 1: £302.5

Week 2

Starting bankroll: £302.5

Bets: 17

P/L: +13.37 points

Bankroll after week 2: £436.25

Week 3

Starting bankroll: £436.25

Bets: 24

P/L: +0.19 points

Bankroll after week 3: £438.15

Week 4

Starting bankroll: £438.15

Bets: 25

P/L: +6.37 points

Bankroll after week 4: £501.9

With BackLucrative Value, we were able to build a conservative £250 bankroll up to £501.9 (100.76% increase), in just four weeks. You can view the results history here.

If the results hadn't turned out so good, with the contingency plan in place we could have topped our bankroll up if needed.

This is one viable way to maximise your betting profit without requiring a large initial investment, and without increasing your risk to unsustainable levels.

With UK racing resuming very soon, this could prove a useful strategy if you're looking to start betting again, and want to squeeze as much profit as you can from a conservative bankroll.